45L Tax Credit Update

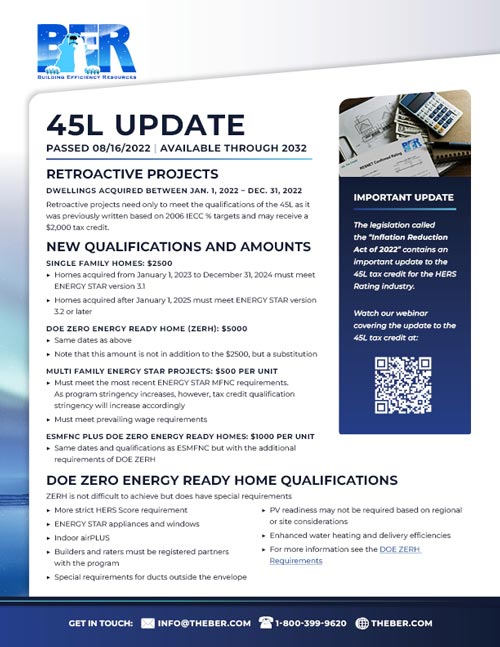

UPDATE August 2022: The recent Inflation Reduction Act of 2022 contains an important update to the 45L tax credit for the HERS Rating industry.

45L Tax Credit Update Webinar

BER recently held a live webinar covering the expected updates to the 45L update. Watch the recording below:

Download the 45L Tax Credit Update Onesheet

Download the 45L Tax Credit Update Onesheet

BER has released a one-page summary outlining the major details of the tax credit update. Download a copy today.

UPDATE November 2021: Congress Reconciliation Bill includes proposal for 10 year extension of 45L. According to Accounting Today, the proposal includes $2500 for ENERGY STAR Certified Homes & $5000 for DOE Zero Energy Ready Homes. BER will keep our Raters posted with any new developments as we learn of them.

As HERS Raters, the 45L tax credit can be a major asset to selling the idea of building a high-efficiency rated home. As the Pro’s Pro, BER is committed to helping you stay up-to-date on legislative developments impacting the energy efficiency industry.

Both the current Legislative and Executive branches of the US Federal Government appear to recognize the importance of the 45L tax credit, and are working to extend the credit for a longer period of time than previous iterations. There are multiple competing proposals that would potentially update and extend the credit being considered in Congress.

Current proposals being considered would potentially extend the tax credit for five years, increase the amount of the credit from $2,000 to $2,500, and update the required energy savings for receiving the credit. Some proposals suggest using ENERGY STAR Certified Homes as a baseline with a bonus for DOE Zero Energy Ready Homes, while others simply update the % savings versus a version of the IECC as we have with the current credit.

Although the path for extending the credit is not yet clear, we are optimistic that these updates will be passed. These revisions could help grow the HERS industry and increase the quality of new builds in the United States. BER will continue to update you on this and other industry advancements as we learn more.